Ky Income Tax 2024

Ky Income Tax 2024. The policy report finds that in other states,. On february 17, 2023, kentucky governor andy beshear signed into law h.b.1, which lowers the state personal income tax rate to 4.5% retroactive to january 1, 2023, and to.

Estimate your tax liability based on your income, location and other conditions. You may use the tool below for the.

(Ap) — Kentucky's Individual Income Tax Rate Is Set To Remain The Same In 2025 After The State Failed To Meet Certain Fiscal Requirements That.

This differs from the federal income tax, which has a progressive tax system (higher rates for higher income levels).

Miller Has Established The Tax Interest Rate Effective January 1, 2024, To Be 9%, Which Is An Increase To The Rate For 2023.

Calculate your kentucky state income taxes.

Ky Income Tax 2024 Images References :

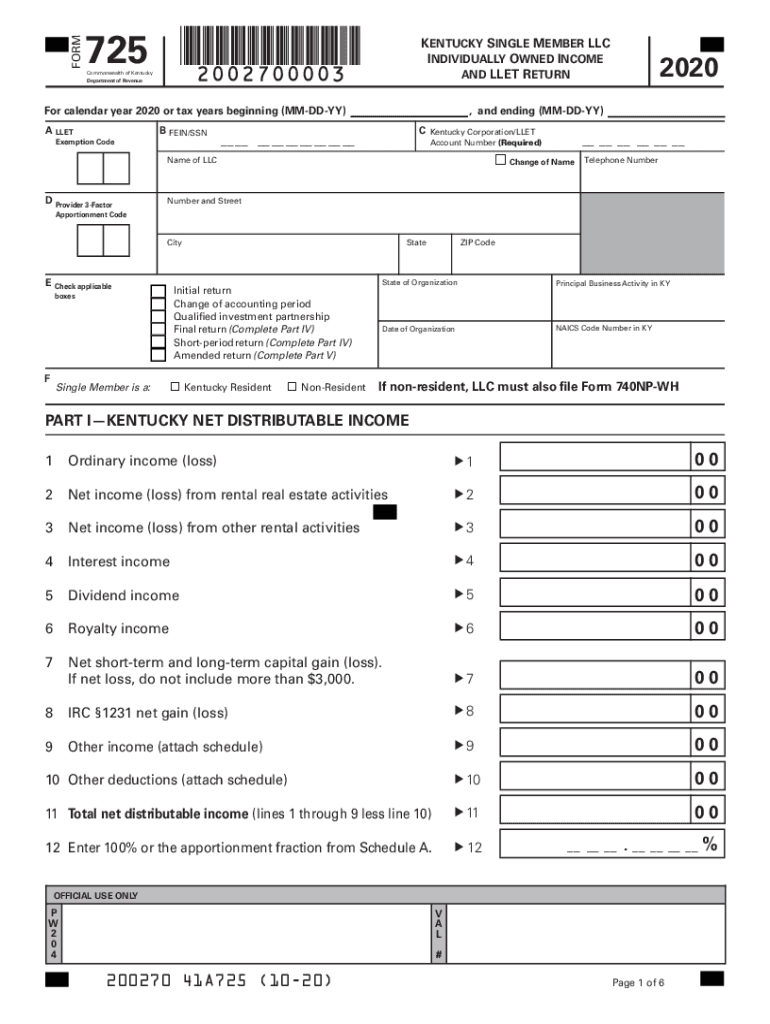

Source: ardaqmoselle.pages.dev

Source: ardaqmoselle.pages.dev

Kentucky Tax Withholding Form 2024 Rani Valeda, Select the kentucky income tax forms and schedules that fit your filing needs; Miller has established the tax interest rate effective january 1, 2024, to be 9%, which is an increase to the rate for 2023.

Source: cinderellawcathe.pages.dev

Source: cinderellawcathe.pages.dev

Kentucky Withholding Form 2024 Marin Sephira, Visit our individual income tax page for more information. 2024 kentucky local income taxes we have information on the local income tax rates in 218 localities in kentucky.

Source: ky-us.icalculator.com

Source: ky-us.icalculator.com

120k Salary After Tax in Kentucky US Tax 2024, Kentucky imposes a flat income tax. Calculate your kentucky state income taxes.

Source: www.signnow.com

Source: www.signnow.com

Ky Tax Part 20202024 Form Fill Out and Sign Printable PDF Template, (ap) — kentucky's individual income tax rate is set to remain the same in 2025 after the state failed to meet certain fiscal requirements that. Miller has established the tax interest rate effective january 1, 2024, to be 9%, which is an increase to the rate for 2023.

Source: www.signnow.com

Source: www.signnow.com

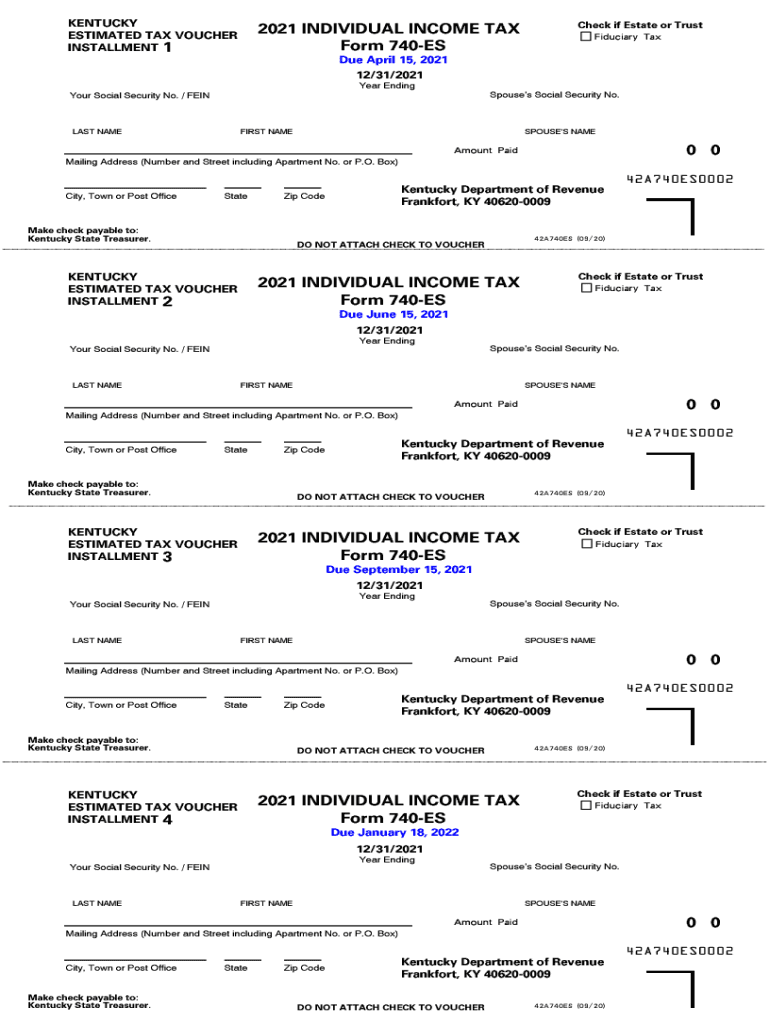

Kentucky State Estimated Tax Payments 20212024 Form Fill Out and, Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and. It says even a much smaller voucher program would drain almost $200 million annually from the kentucky state budget.

Source: daraqmarnia.pages.dev

Source: daraqmarnia.pages.dev

Ma State Tax Rate 2024 Olga Tiffie, Income tax tables and other tax information is sourced from the kentucky department of. The individual income tax rate for 2024 has also been established to be 4.0%, a reduction by.5% from the 2023 tax rate.

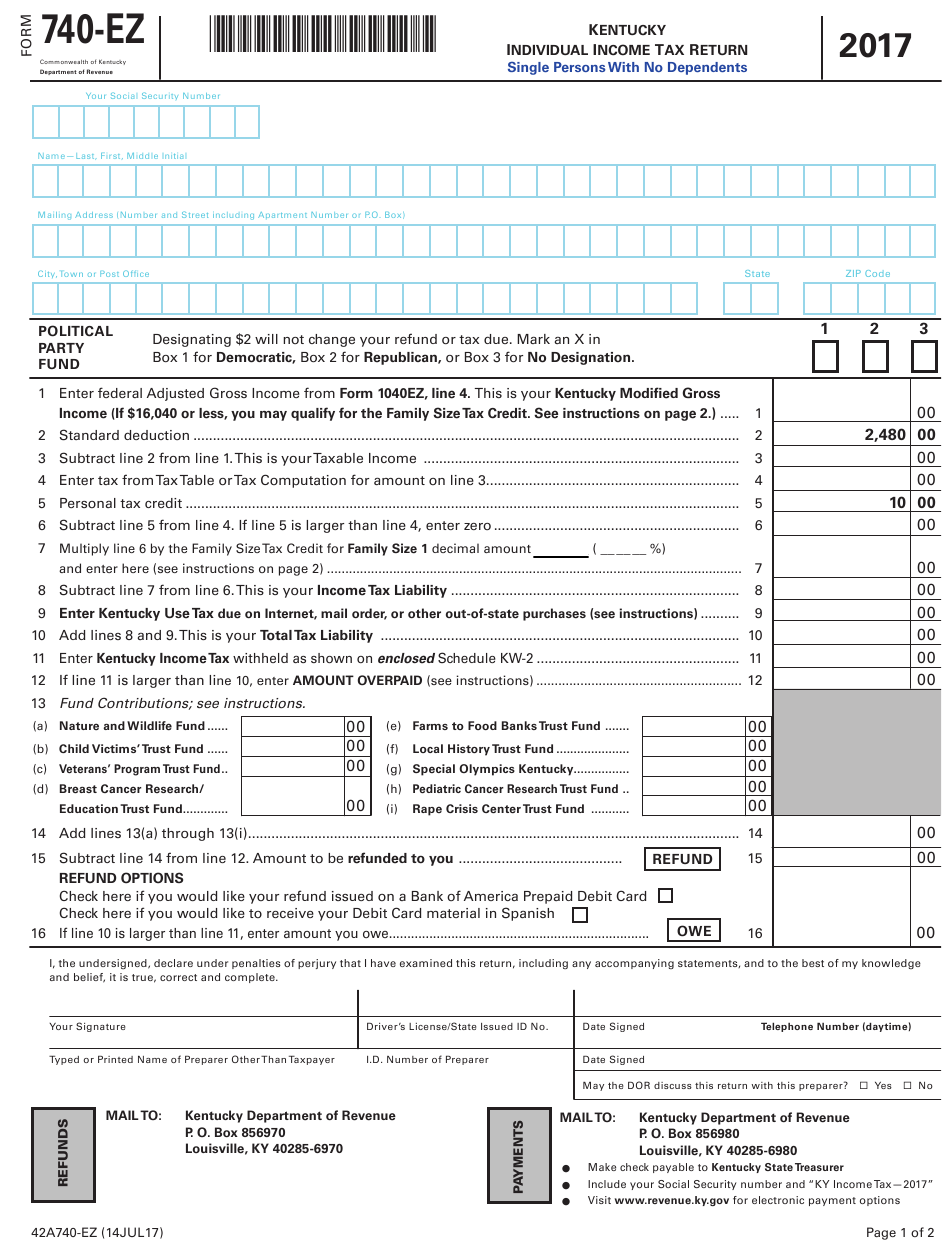

Source: www.signnow.com

Source: www.signnow.com

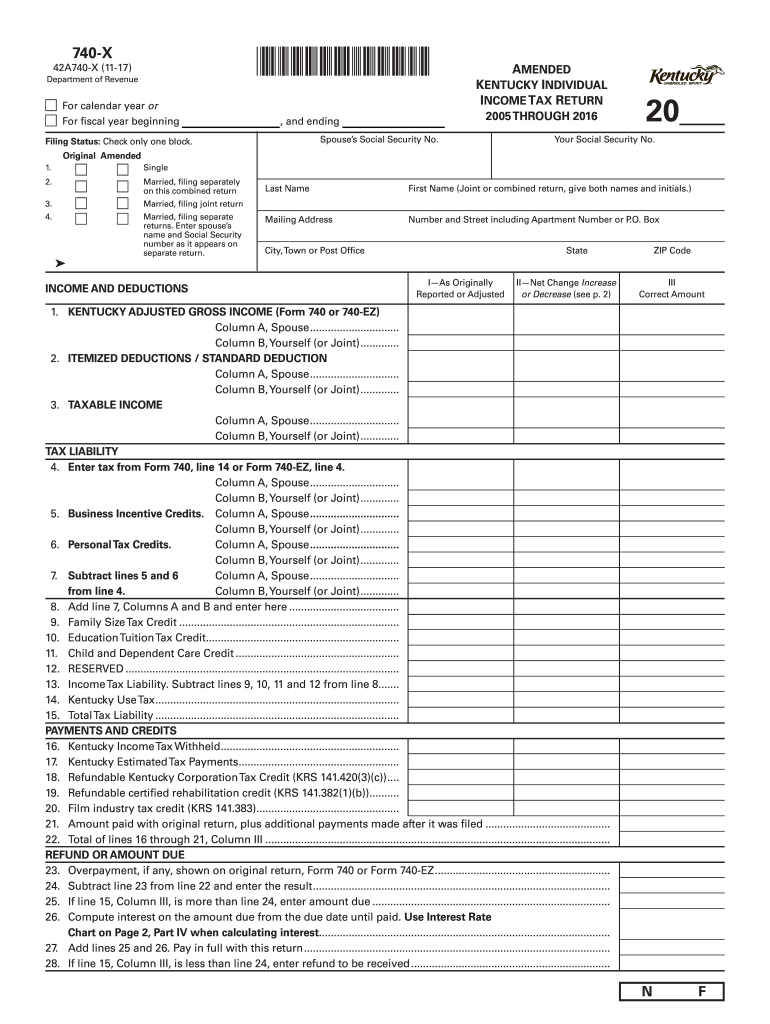

Ky Tax 740 20172024 Form Fill Out and Sign Printable PDF, Updated on jul 06 2024. Calculate your kentucky state income taxes.

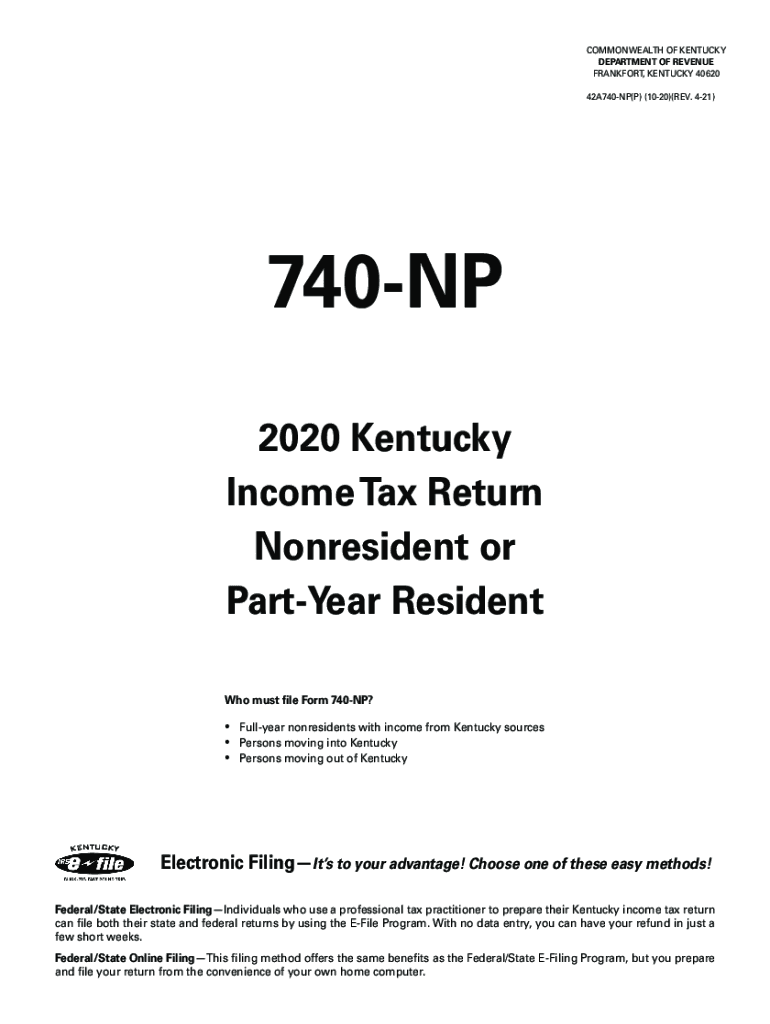

Source: www.signnow.com

Source: www.signnow.com

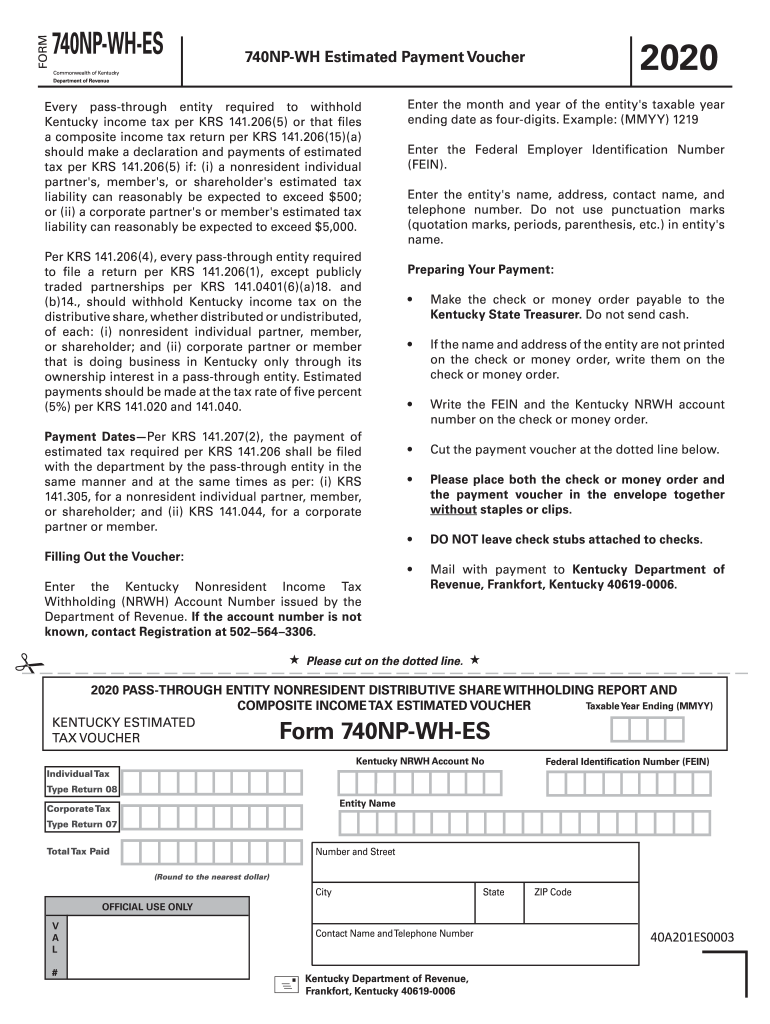

740np Wh 20202024 Form Fill Out and Sign Printable PDF Template, Interestingly, kentucky law reduced personal income tax rates for 2023 and 2024 after governor andy beshear signed law h.b.1 on february 17, 2023. Typically, the percentage of your paycheck that goes to taxes in kentucky will be around 20% to 35%.

Source: www.taxuni.com

Source: www.taxuni.com

Kentucky State Tax 2023 2024, You can quickly estimate your kentucky state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to. Typically, the percentage of your paycheck that goes to taxes in kentucky will be around 20% to 35%.

Source: www.taxuni.com

Source: www.taxuni.com

Kentucky Tax Calculator 2023 2024, Use our income tax calculator to estimate how much tax you might pay on your taxable income. You may use the tool below for the.

The Kentucky Tax Estimator Will Let You Calculate Your State Taxes For The Tax Year.

Interestingly, kentucky law reduced personal income tax rates for 2023 and 2024 after governor andy beshear signed law h.b.1 on february 17, 2023.

Zillow Has 52 Photos Of This $550,000 4 Beds, 3 Baths, 2,855 Square Feet Single Family Home Located At 32.

Estimated individual income tax payments may now be scheduled through our electronic payment system.

Posted in 2024